Introduction

The Greater Peoria Economic Development Council recognizes the need for reliable predictive data to better understand the needs of the future Greater Peoria workforce. Data-driven programming requires a knowledge of the current state of the Greater Peoria labor market as well as a forecast of the future talent needs of the Greater Peoria economy.

The Greater Peoria Economic Development Council began conducting the Talent Forecast in 2016 with the goal of identifying and publicizing regional hiring trends and needs. A survey was delivered to major employers in Greater Peoria primary industry clusters to identify the specific jobs that employers were hiring. Findings from the initial survey were utilized to inform GPEDC workforce programming.

The goal of this analysis is to identify hiring trends as well as the gaps that exist between the demands of Greater Peoria employers and the skills, experiences, and education of the Greater Peoria population. Understanding this gap requires greater knowledge of the needs of employers as well as the demographic, educational, and socioeconomic factors that drive the quality of the regional workforce. This work has implications for regional programming in education, training, talent recruitment and retention, and business attraction and development.

This year’s Talent Forecast takes a multi-faceted approach to identifying the needs of the Greater Peoria workforce. Analysis was done across both the supply and demand sides of the labor market, identifying the trends in industry and education that determine workforce outcomes.

Regional data profiles were created highlighting regional demographic trends, industry job demand, changing occupational needs, and educational completion statistics. This analysis was done utilizing data at the regional level as well as the county and local levels, to identify workforce development themes for both regional and local programming.

Regional Demographic and Economic Trends

Demographic Trends

The population of Greater Peoria is projected to decline from 2017 to 2027 by approximately 4,500 people. Population is projected to decline in all Greater Peoria counties with the exception of Woodford County. Mason County is projected to experience the most dramatic population decline, losing approximately 7.5% of its population over the next decade. These trends continue population trends of the past decade, where the Greater Peoria suburban communities and communities located near major interstates have experienced growth while highly urban and rural communities have experienced population decline.

The data below can be changed to display data from any of the 5 counties by clicking on counties on the map.

Commuting Trends

With over 48,000 workers commuting out and just over 49,000 commuting in, Greater Peoria has a balanced flow of workers. The region sends the most workers to neighboring McLean County (7,809, 4.7%) and Sangamon County (4,942, 2.9%). Most of the workers coming from outside of the region are from McLean County (5,408, 3.2%) and Fulton County (3,533, 2.1%).

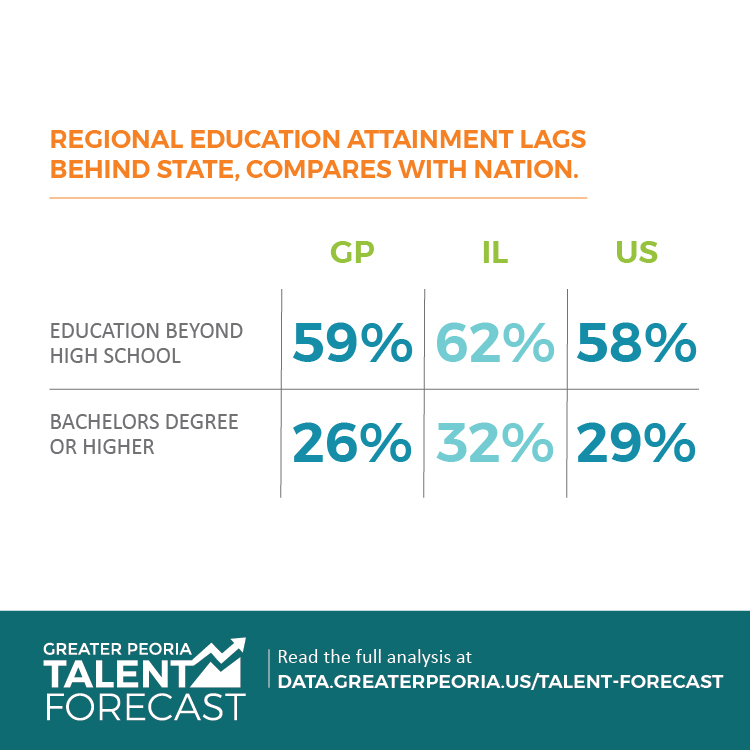

Educational Attainment

The region has a lower educational attainment rate than both the state and the country. 35% of the Greater Peoria population has a degree higher than high school, compared to 40% at the state level and 37% at the national level. Woodford County has the highest educational attainment in the region.

Below is a visualization of proportions of educational attainment in the region. The pie chart on the left represents our region, and can be manipulated to represent any county in Greater Peoria via the dropdown menu.

Regional Jobs Profile

Jobs by Geography and Industry

Since 2000, Greater Peoria has experienced large fluctuations in the number of jobs. The region experienced peaks in the number of jobs in 2008, prior to the effects of the Great Recession, and 2013. Most jobs in the region are located in Peoria, East Peoria, Morton, Pekin, and Lincoln. Cities located close to I-74 and I-55, particularly Mackinaw and El Paso, have experienced significant growth, while communities far from major interstates, such as those in Mason County, have seen declines in the number of jobs.

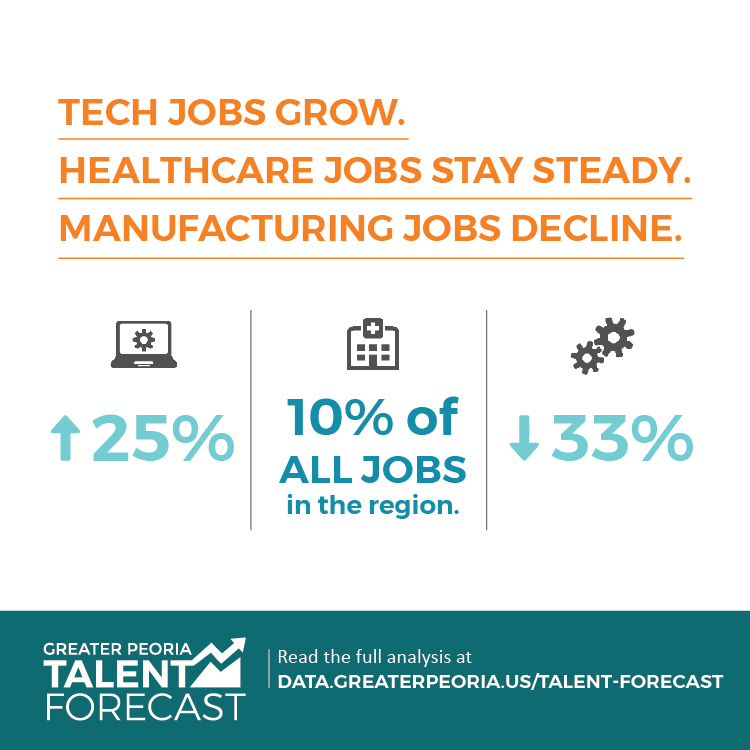

The broad industry sectors in Greater Peoria employing the most workers are Health Care and Social Assistance, Government, Manufacturing, Retail Trade, and Accommodation and Food Services. Among these top five industries, manufacturing has experienced the greatest change over the last ten years, losing over 10,000 jobs in the last decade. Accommodation and Food Services has seen the greatest positive change of these five industries, adding over 700 jobs since 2007.

Looking at more specific industries, the construction industry has declined, with reductions of ~30% of its workforce since 2008. Similarly, machinery manufacturing has declined since the Great Recession, with over 5000 jobs lost.

The chart below shows EMSI estimate data on regional jobs from 2001-2016. The visualization shows estimates of changes in job numbers within cities, within industries, and within specific industries in cities. To adjust the data by industry, select your industry of choice from the Industry Description dropdown menu. To adjust the data by community, select your community of choice from the City dropdown menu. To display an industry within an individual community, select the industry from the Industry Description drop down menu and the community from the City drop down menu.

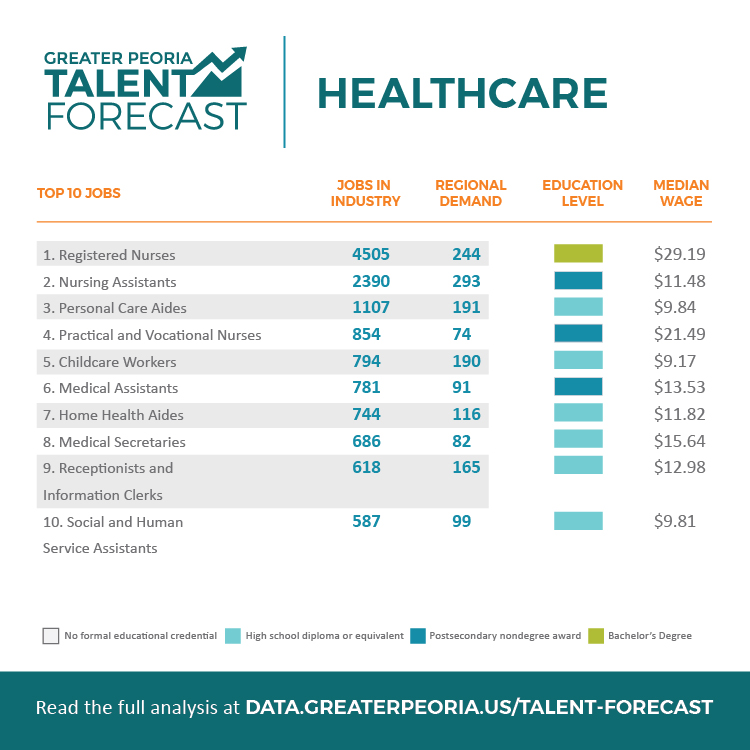

Jobs by Occupation

The region’s top occupations by employment include Office and Administrative Support Occupations, Food Preparation and Serving Related Occupations, Sales and Related Occupations, Healthcare Practitioners and Technical Occupations, and Management Occupations. The median hourly earnings range from $9.64/hour for Food Preparation and Serving Related Occupations to $43.95/hour for Management Occupations.

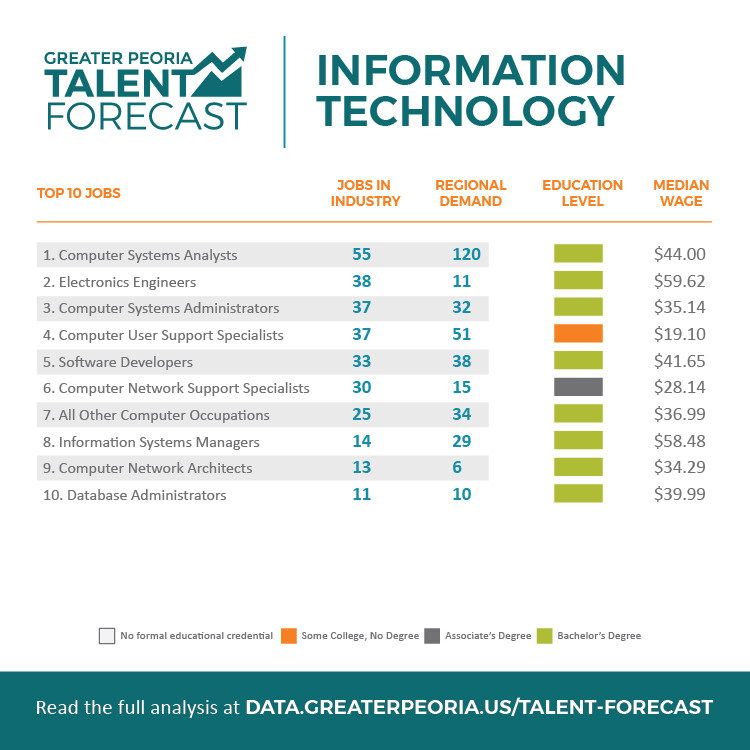

Production occupations have experienced a decline, with particular decreases in machinists and team assemblers. Computer and mathematical occupations have experienced a large increase in jobs since 2001, in part due to a large increase in the number of computer systems analysts.

To display data on the following visualization, click on a job category and then click on a specific occupation.

Jobs by Education and Experience

The existing jobs in the Greater Peoria economy are diverse in the range of education and experience requirements. Approximately 40% of existing regional jobs have entry level requirements of more than a high school degree. The visualization below displays the entry level education, experience, and training required for existing jobs in the region.

Regional Labor Market Supply

The GPEDC only has access to regional data, however, the labor market is today national and international in nature. Most companies and workers have access to online job boards that allow them to look beyond the borders of Greater Peoria to look for workers and work. However, the ability of a region to supply its own labor market is vitally important to the sustainability of a region. These data points show the ability of the Greater Peoria laborforce and educational institutions to fill labor market needs.

The Regional Laborforce and Unemployed Population

The regional labor supply consists of all individuals in the labor market, including those looking for work and those currently employed in the region. The Greater Peoria laborforce has been gradually declining since 2010. The laborforce population peaked in the summer of 2010 with over 212,000 workers but has declined to approximately 191,000 workers. While the national laborforce has also been in decline due to the retirement of the baby boomer generation, the rate of decline in Greater Peoria likely signifies that workers are moving out of the region as well as retiring.

Unemployment in the region has trended to be slightly higher in Greater Peoria than in the United States as a whole, remaining approximately a percentage point above the national average. As of June 2017, Greater Peoria had an unemployment rate of 5.5% while the U.S. had an unemployment rate of 4.4%. However, the Greater Peoria average is not consistent across the entire region, as unemployment in Mason and Peoria counties have been well above regional and national averages, while unemployment rates in Logan, Tazewell, and Woodford Counties tend to be lower.

Unemployment by Industry

Declines in the manufacturing and construction industries have resulted in a bulk of the regions unemployment. As of October 2017, Greater Peoria had approximately 10,300 residents out of work, 1,210 of them formerly employed in the manufacturing industry and 1,064 employed in the construction industry. Retail trade, healthcare and social assistance, and administrative and support industries made up the top five in terms of number of unemployed workers.

However, while the number of unemployed is high in certain industries, the unemployment rate is not as high. For example, the healthcare industry has 1,014 unemployed workers in the region, however, because the industry has a laborforce of over 30,000, the unemployment rate of healthcare workers is really quite low at 3.2%. In contrast, construction has a high number of unemployed workers and a high unemployment rate with approximately 10.9% of the construction workforce listed as unemployed in August of 2017.

Unemployment by Occupation

Occupations closely tied to the manufacturing and construction industries, including Construction and Extraction occupations, and Production occupations, have the highest levels of occupational unemployment. As a trend, occupations that require a higher level of educational attainment have lower rates of unemployment.

Regional Educational Pipeline

The health of the regions workforce vitally depends on new talent entering the workforce, and that talent having the skills and abilities necessary to be successful in their given career field. This process starts at schools and continues into higher education. Understanding how successful our schools are at preparing students for the workforce, both at the high school and college level, is vital to predicting the future of our workforce. The region must know if schools are graduating students, if they are preparing students for college, and what degrees students are completing in higher education institutions.

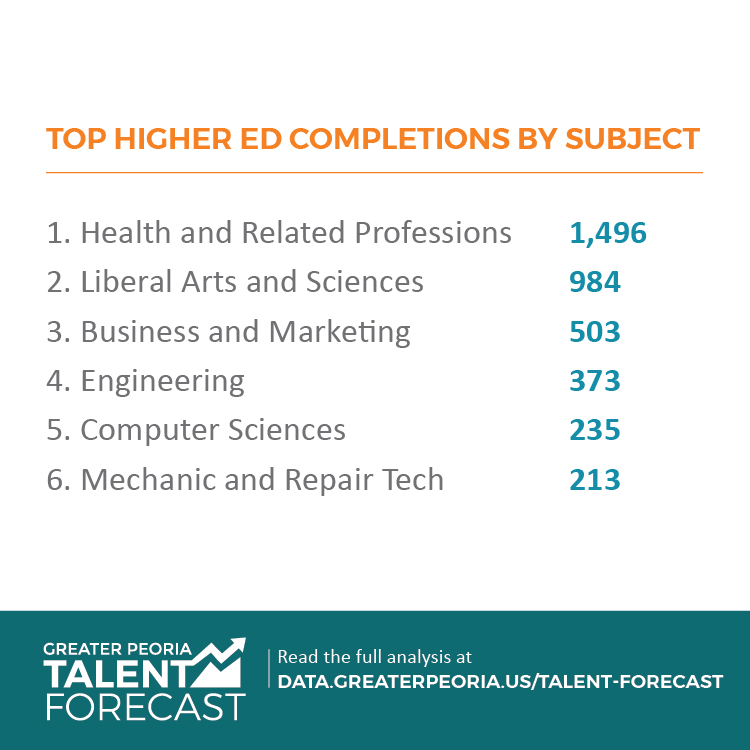

Higher Education Completions

Almost half of all educational completions in Greater Peoria are in two subject areas: health professions and liberal arts and sciences. Approximately two-thirds of all liberal arts and science degrees completed in the region are completed at Illinois Central College, while degrees in health professions are scattered across universities.

Illinois Central College produces the most graduates in the region, followed by Bradley University. Bachelors degrees are the most commonly received degrees, followed by associates degrees. Missing from this data is the number of associates degrees received as a precursor to a bachelors degree versus the number of associates degrees that are an individual’s final degree.

The following chart displays a breakdown of received degrees split by subject and degree. The data can be sorted by institution using the dropdown menu.

Job Openings and Projections

Job openings data represents the number of jobs that are available to the workforce in a given year. These numbers, while useful, may not be representative of the future workforce. Due to more rapid job turnover in certain fields and the ratio of new to replacement jobs across industries, job openings figures can exaggerate the long term demand for certain jobs. However, job openings figures are useful in displaying the labor market at a particular point in time, and for displaying the situation for companies trying to find workers, workers trying to find jobs, and career programming in matching the two together.

Below is a listing of the projected job openings in Greater Peoria in 2018, as well as the job requirements and median hourly earnings for each job. Greater Peoria is projected to have approximately 20,993 job openings in 2018. Of these openings, approximately 70% require no more than a high school diploma. However, for jobs that have median hourly earnings of at least the region’s median hourly wage of $24.80, 75.9% require schooling after high school.

The graphic below can be used to sort the number of job openings by minimum median wage. Use the slider below to see how educational requirements change for higher wage jobs.

Below is a list of estimated job openings by specific job type. The graph can be sorted by wages and educational requirements.

Implications of Findings

Need for Increased Educational Attainment

Higher educational attainment is beneficial at both the individual and regional level. Regions with higher levels of educational attainment are more attractive to outside investment, and have an easier time retaining existing employers. Since the region currently lags behind the state and nation in the proportion of individuals with bachelors degrees or higher, the region should seek to increase its levels of educational attainment. Doing this would keep the region competitive at the state and national level, and would help meet the demands of regional employers.

Additionally, increasing educational attainment should help individuals in Greater Peoria live better lives. Statistically, individuals with a bachelors degree or higher make more in their life times, even after accounting for additional debt. Also, the unemployment rate decreases among cohorts with higher levels of education.

However, the region should seek to increase educational attainment in a sustainable manner. Tuition costs are increasing for private and public universities alike, and the cost of attending college is higher than ever. Thus, regional actors seeking to increase levels of educational attainment should focus on career-focused solutions to encouraging additional schooling.

Need for External Recruitment

The population of Greater Peoria is declining, and the laborforce is following suit. As the population of Greater Peoria declines and the workforce ages, the region will continue to see decreases in consumer demand and available workforce. Both of these factors make operating a business in Greater Peoria less tenable, and lead to a vicious cycle for the region.

To overcome these hurdles, the region should focus efforts on retaining the existing workforce and attracting new residents to the region. Regional branding and marketing provide short term strategies for attracting and retaining residents. However, for a longer term, sustainable strategy, the region should develop strategies and assets that make the region a better place to live, work, and play.

Re-Training Programs

Due to market demand, regional changes, and technological advancement, the region has seen major declines in jobs that the region has relied on for years. Many workers, particularly in the manufacturing sector, will likely be forced to change careers in their lifetime, either within the industry or across the economy. Tech and healthcare jobs are

Preparing students for the jobs of the future will help alleviate some of the problems associated with industry change, however, measures should be taken to help the existing workforce. Worker retraining programs should be explored and funded as necessary. This report recommends further research to identify target professions.

Limitations and Next Steps

Limitations

This report is primarily limited by the quality of the data. Due to inconsistency in how data is reported, numbers for certain jobs may be under or over-reported. Farm jobs in particular, due to their unique nature, are often under-reported by government and EMSI estimates, and are likely underrepresented in the data.

This report also is limited due to its reliance on secondary analysis of government and proprietary data sources. Topic specific quantitative data and qualitative data collected through primary sources would add more context to this analysis. Further research should identify other workforce areas of concern and seek to provide more primary data.

Next Steps

1. Further Research

This report primarily relied on EMSI estimates utilizing large scale government data. While this data is useful for providing additional insight into the state of Greater Peoria’s regional workforce, this data lacks the local context necessary to provide prescriptive insights to solve local workforce issues. Further research should seek to identify concrete challenges faced by employers, workers, educators, and social workers. Additionally, topic-specific studies may be useful for identifying the importance of certain strategies. For example, a study identifying the distribution of student debt burden in the region would be useful for identifying the importance of career planning strategies. There are a number of questions that, if answered, could help to plan strategies. These questions include, but are not limited to, the following:

- What percentage of Greater Peoria students pursue internships during their high school career?

- How many job openings remain unfilled across the region in a given year?

- What specific skills do local employers look for in job applicants? How do those differ by industry/occupation?

- What difficulties do job seekers in the region face when looking for employment? What are the similarities and differences between job seekers and how can regional programming meet their needs?

Further research should seek to give light to these different issues, and should use data from previous research (including this report) to give context to findings.

2. A Workforce Institutional Analysis

While this report looked broadly at workforce data in the region, this report contains no discussion of the current strategies being employed across the region by cities, school districts, colleges, and non-profits. In order to formulate the region’s workforce needs, further analysis should highlight the strategies being employed as well as the organizations and institutions that are pursuing those strategies. This analysis should discuss the distribution of strategies across the region, as well as the geographic and organizational gaps that exist to address workforce problems.

3. A formalized regional workforce strategy

Utilizing data-points used in this report, future research, and an institutional analysis, the GPEDC and other regional partners should seek to create a formalized regional workforce strategy. This strategy should include regional goals, a formalized structure, assigned roles for institutions and organizations, and logic models to define how goals will be met. This strategy should seek to be as inclusive as possible, including representatives from across the region.

4. Regular data tracking of regional workforce statistics

Since the regional workforce is constantly changing, a comprehensive workforce analysis should be done on a annual or biannual basis to identify changes in workforce trends. Additionally, the region should consider developing a series of workforce metrics that can be featured in a central location. This central data center should also feature information and data on regional workforce strategies.