Fourth Quarter 2019 Business and Economic Indicators

Report provided by ![]()

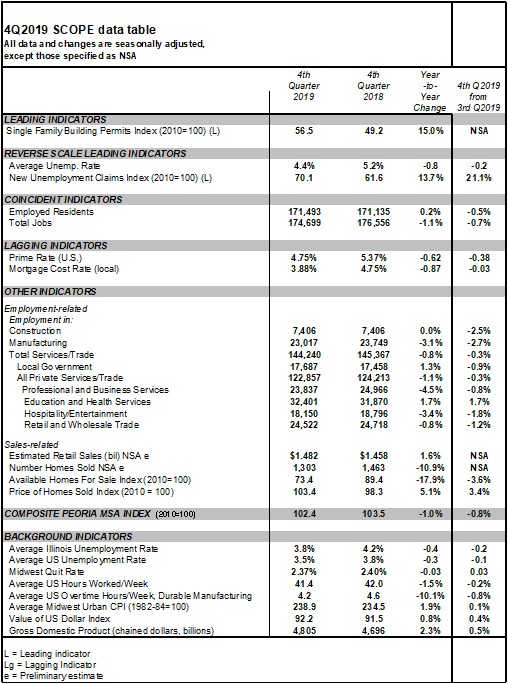

The Composite Index of Business and Economic Indicators of the Peoria-Pekin Metropolitan Statistical Area (MSA; Peoria, Tazewell, Woodford, Stark and Marshall counties) for the third quarter was computed at 103.1, similar to the previous quarter and year earlier levels (See chart, above). The third quarter Index level controls for normal seasonal growth trends among the key seasonally adjusted labor market, job market and local sales indicators studied.

A detailed analysis of these data appears below. Data reported are adjusted for normal seasonal variation, unless specified otherwise.

Review and Outlook

Looking ahead, the local “leading indicators” (that signal future levels of economic performance) are mixed, pointing to little overall growth for area employers in the short term.

Longer term area business and economic growth trends are expected to result from regional capital investment projects; the retirements of members of the large post-World War II “baby boom” cohort replaced by local job seekers (see Reinhold, 2018 for research on retirement and Illinois labor force); and from increases in the numbers of the self-employed and entrepreneurs among area residents.

Bernard Goitein, PhD

Professor of Management and Leadership

Foster College of Business

Joshua Lewer, PhD

Professor of Management and Leadership

Foster College of Business

Matthew Nordin

Research Assistant

Foster College of Business

© Bradley University

Reinhold, Rich, “Declining Labor Force Participation in Illinois:Why Have More People Stopped Working or Looking for Work” Illinois Department of Employment Security | Economic Information and Analysis Division | January 2018 http://www.ides.illinois.gov/lmi/ILMR/DecliningLaborForce.pdf